Introduction

Executive Summary

We think the significance of three ESG indicators – experience of the board and management, corporate social responsibility and stakeholder capitalism – has increased in the current environment, especially for identifying companies with likely sustainable growth

Management and board expertise in handling major crises/potential business restructuring will play a key role in guiding companies through these turbulent waters

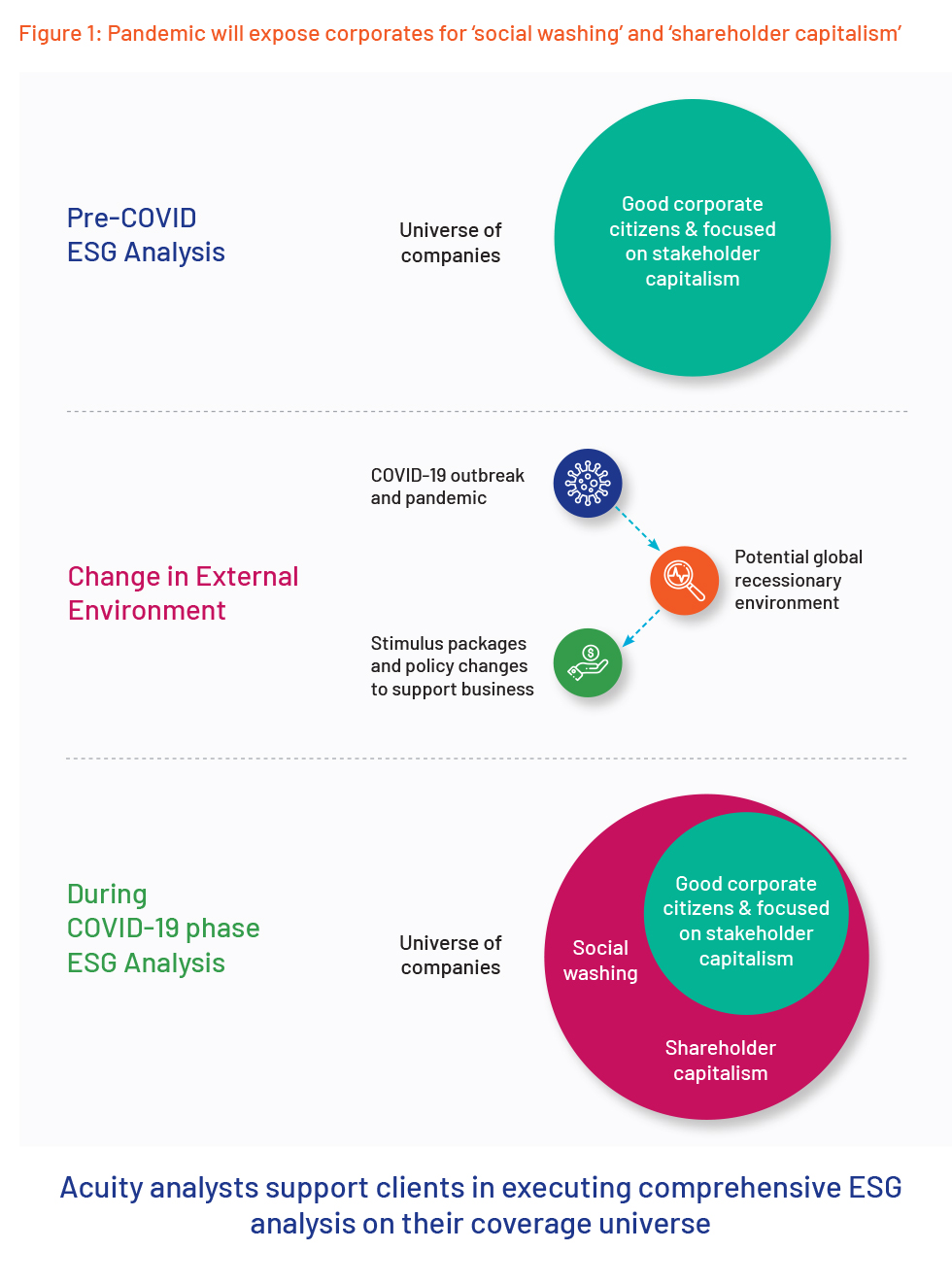

The pandemic and the aftermath should help identify companies engaged in ‘social washing’ and the ones missing focus on ‘stakeholder capitalism’

Introduction/Overview

Three ESG parameters together are of greater significance as the COVID-19-led crisis plays out. The COVID-19 outbreak has created significant uncertainty for businesses. As companies prioritise overcoming short-term survival risks, they also need to focus on sustainable growth and long-term value creation for all stakeholders. In the current environment, we think three ESG parameters below can help investors identify companies that are likely to have sustainable growth.

Board and management with crisis handling/restructuring experience - Despite significant support from governments in the form of stimulus packages and policy changes (policies deterring company acquisitions by a foreign entity), crisis management and business restructuring skills of executive teams and boards will be key in guiding companies through these turbulent waters and, therefore, will be a major differentiating factor among companies. This analysis is more meaningful for companies in sectors that have been severely hit by the COVID-19 outbreak and the restrictions that followed thereafter.

Distinguishing between companies engaged in social washing and good corporate citizens - Employee welfare is not a priority for all executive teams, especially when social responsibility of the business is not driving their compensation. The pandemic is expected to bring more clarity on management priorities and help distinguish between companies that are ‘good corporate citizens’ and those engaged in ‘social washing’. A good case study is that of 188 US-based companies that signed a new statement on the Purpose of a Corporation in August 2019, committing to deliver value to all stakeholders. Ironically, some of them have laid off and furloughed employees within a month of the outbreak of the pandemic in the country and few others have announced their intentions to do so.

Identifying management teams with a focus on ‘stakeholder capitalism’ - Globally, there has been an increasing focus on transitioning corporates towards ‘long-term value creation’, which requires balancing the interests of various stakeholders, also termed as ‘stakeholder capitalism’. In the current scenario, many management teams are struggling to balance short-term business risks and long-term value. In the next section, we explain this in the context of the COVID-19 response of some global banks. The actions taken by these banks indicate that shareholders are on the receiving end, and over the coming months, these banks will have to demonstrate their ability to achieve balance in terms of managing different stakeholder interests. Companies demonstrating ‘stakeholder capitalism’ in the current environment will be a key differentiating factor from an ESG perspective.

Key Challenges

Management And Board Expertise In Restructuring / Crisis Management While government stimulus support during the current pandemic is likely to ease out the short-term risks for various companies, at the end of the day, a large share of support is in the form of loans that would add to a company’s leverage and need to be serviced at a later date. To avoid the adverse impact of high leverage at a future date and be sustainable in the medium-to-long term, company management will need to take various decisions, especially with regard to the company’s fixed costs and business strategies. These could relate to employee layoffs, salary cuts, changes to supply chains, centralisation or diversification of operations, marketing models, changes to the product portfolio and so on. The company board will need to work closely with management and guide them in making the right decisions. These decisions made by the company will determine its future, as not all companies will survive the economic turbulence created by COVID-19.

Management’s Focus On Corporate Social Responsibility - In August 2019, America’s Business Roundtable, a forum of around 200 large corporations from the US, released a new statement on the Purpose of a Corporationi , signed by 181 CEOs who committed to leading their companies for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders. The statement reads, “We commit to deliver value to all of them, for the future success of our companies, our communities and our country.” This implies that investing in employees, delivering value to customers, dealing ethically with suppliers and supporting outside communities are at the forefront of their business goals. However, within a month of the first COVID fatality in the country, some signatories to the charter have already started to layoff or furlough employees and few others have announced their intentions to do so. In less than two months of recognising the pandemic, the number of jobless claims in the US have jumped to 26mii

.The COVID-19 pandemic has exposed statements, such as the Purpose of a Corporation, as nothing more than hollow promises. By signing these statements, there are companies attempting to satisfy investors, while giving other stakeholders an impression that the company is a steward of public good and will be taking care of their needs.

Management’s Focus On Stakeholder Capitalism –

A key objective of stakeholder capitalism is ‘long-term value creation’, with a focus on sustainable growth rather than short-term profits. We think pandemic-driven management strategies and actions will enable investors to differentiate between companies based on their ‘stakeholders’ vs. ‘shareholder’ focus. While a proper analysis requires relevant details on company actions, which may be available after a few months or at the year end, a preliminary analysis with information available at any point in time can provide some insights. As a case study, we look at the business response of 20 large banks (with their headquarters either in the US and Europe) to COVID-19 for a preliminary assessment of their actions on ‘stakeholder capitalism’.

Benefits

We think that three ESG factors - expertise of the company’s board and management in crisis management or business restructuring, company’s delivery on its corporate social responsibility, and management’s efforts towards driving stakeholder capitalism – are of greater significance in the current environment. A comprehensive analysis of companies on these three factors will enable investors to identify companies that are more likely to have sustainable growth versus their peer group.

Future outlook

The pandemic and its economic impact are likely to change the fate of some companies. We think companies with executive teams and company boards that have expertise in crisis management/ financial restructuring are better positioned to sail through this turbulent time and could emerge winners, with even stronger business models.

We believe COVID-19 is likely to expose companies that have been resorting to ‘social washing’ and put the spotlight on good corporate citizens. Taking into consideration individual company circumstances, investors will need to analyse whether the company’s actions are consistent in its treatment of staff and executives.

The current environment is likely to make it difficult for company management to balance the interests of different stakeholders. Management teams that can demonstrate focus and commitment towards ‘stakeholder capitalism’ are more likely to deliver sustainable growth.

Conclusion

Company managements that can successfully deliver on their corporate social responsibility during such tough times are likely to win the trust of their employees and customers. The goodwill created can go a long way in driving growth for the company. Hence, identifying ‘good corporate citizens’ during the pandemic phase could act as a key differentiating factor.

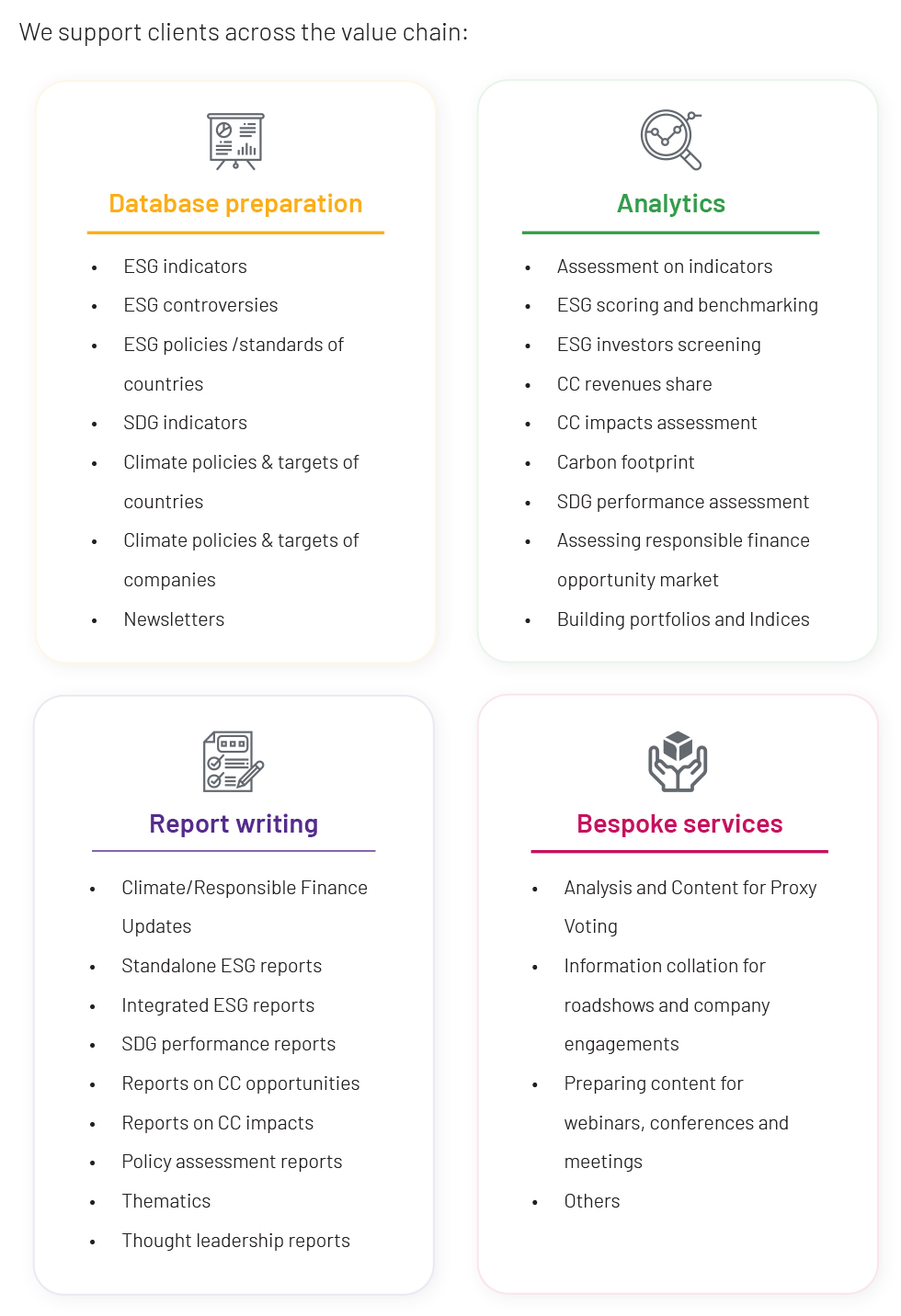

Acuity’s Value proposition